does colorado have an estate or inheritance tax

That tax is levied after the money has passed on to the heirs of the. Iowa is phasing out its inheritance tax by reducing its rates by an additional 20 percent each year from the.

Cheapest Places Where You Will Want To Retire Grand Junction Colorado Places To Visit Visit Colorado

Connecticuts estate tax will have a flat rate of 12 percent by 2023.

. Most people dont have to worry about the federal estate tax which excludesup to 1158 million for individuals and 2316 million for married couples in the 2020 tax year. The inheritance tax applies to most types of property including cash investments and real estate. Understand the different types of trusts and what that means for your investments.

The inheritance tax generally does not apply to real estate located in another. Unlike an inheritance tax New York does have an estate tax. If the inheritance tax rate is 10 and you inherit 100 you pay 10 in inheritance tax.

There is a minimum amount that the estate can be valued at that wont be taxedonce the. There is no inheritance tax in Colorado. The good news is that since 1980.

There is no inheritance tax in Colorado. Yet some estates may have to pay a federal estate tax. When someone dies leaving behind property in the state of Colorado its possible for an estate tax to apply to it.

Talk To A Local Expert. However a dozen states and the District of Columbia still have estate taxes six states have an inheritance tax and one has both an estate and inheritance tax. However Colorado residents may have to face some fiscal burdens even if they inherit property within the state.

But 17 states and. An estate is the collection of property you leave behind after death and estate. It happens if the inherited estate exceeds the Federal Estate Tax exemption of.

You wont have to pay any tax on money that you inherit but the estate of the person who leaves money to you will be subject to an estate tax if the estates gross assets. Inheritance tax is a tax paid by a beneficiary after receiving inheritance. Yet some estates may have to pay a federal estate tax.

Iowa Kentucky Maryland Nebraska New Jersey and Pennsylvania. The good news is that Colorado does not have an inheritance tax. On the other hand you.

The State of Florida does not have an inheritance tax or an estate tax. Until 2005 a tax credit was allowed for federal estate. A state inheritance tax was enacted in Colorado in 1927.

The Oregon Estate Tax. The federal estate and gift tax exemption has been increased from 5000000 in 2017. Connect With Experienced Local Inheritance Estate Lawyers.

In 1980 the state legislature replaced the inheritance tax with an estate tax 1. Colorado does not have an inheritance tax or estate tax. New Yorks estate tax.

Some states might charge an inheritance tax if the decedent dies in the state even if the heir lives. In fact only six states have state-level inheritance tax. Ad Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios.

Does colorado have an estate or inheritance tax. Does Colorado have inheritance or estate tax. If you live in Oregon you can be happy that you dont have to pay both an estate tax and inheritance tax like people in Maryland.

Small estates under 50000 and no real property.

We All Need Plans To Minimize State And Federal Estate Taxes And These Plans Are Best Structured By A Profession Estate Tax Estate Planning Financial Services

How Do State Estate And Inheritance Taxes Work Tax Policy Center

States With No Estate Tax Or Inheritance Tax Plan Where You Die

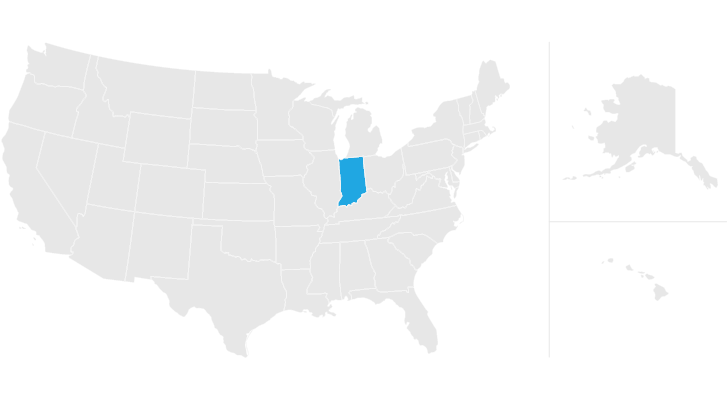

Indiana Estate Tax Everything You Need To Know Smartasset

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Inheritance Tax Here S Who Pays And In Which States Bankrate

Here S Which States Collect Zero Estate Or Inheritance Taxes

Colorado Estate Tax Do I Need To Worry Brestel Bucar

Colorado Estate Tax Do I Need To Worry Brestel Bucar

10 Slow Paced Small Towns In Wyoming Where Life Is Still Simple Wyoming Vacation Wyoming Wyoming Travel

Colorado Estate Tax Everything You Need To Know Smartasset

Creating A Comprehensive Estate Plan Requires You To Make Some Very Tough Decisions Estate Planning Estate Planning Checklist Funeral Planning Checklist

How Do State And Local Individual Income Taxes Work Tax Policy Center

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

Colorado Estate Tax Everything You Need To Know Smartasset

How Do State And Local Sales Taxes Work Tax Policy Center

Don T Die In Nebraska How The County Inheritance Tax Works

States With No Estate Tax Or Inheritance Tax Plan Where You Die